2Mami Insights

Your go-to source for news, tips, and inspiration.

Level Up: Transforming Everyday Purchases into Cashback Treasures

Unlock the secret to earning cashback on your daily purchases! Discover how to turn routine buys into treasure troves of savings.

Maximize Your Cashback: Smart Strategies for Everyday Spending

Maximizing your cashback is easier than ever with a few smart strategies that can transform your everyday spending into significant savings. First, choose the right credit card that offers the best cashback rates for your usual purchases, such as groceries, gas, or dining out. Consider cards that provide bonus categories that align with your spending habits. For instance, if you frequently dine out, opt for a card that rewards you with higher cashback percentages on restaurant charges. This can lead to substantial rewards over time, helping you make the most of your expenditures.

Another vital strategy is to track promotional offers and cashback apps. Many retailers often have partnerships with cashback apps, providing additional savings when you shop. To ensure you never miss an opportunity, create a budget that incorporates these cashback strategies, and routinely check for any new offers before making purchases. By combining these tactics, you can build a robust approach to managing your spending while maximizing your cashback rewards.

Counter Strike is a highly popular team-based first-person shooter game that has captivated millions of players around the world. The game emphasizes strategy, teamwork, and skill as players compete in various game modes. For those looking to enhance their gaming experience, using a clash promo code can provide exciting benefits and perks.

The Ultimate Guide to Turning Routine Purchases into Rewarding Cashback

In today’s consumer-driven world, turning your everyday purchases into rewarding cashback opportunities is not just a smart financial decision but also an effortless way to maximize your spending. By utilizing cashback programs offered by various retailers, credit cards, and mobile apps, you can easily transform routine transactions—such as grocery shopping, online purchases, or even gas fill-ups—into tangible savings. Start by signing up for cashback programs that align with your spending habits, and consider using a cashback credit card that offers higher rewards for your most frequent purchases.

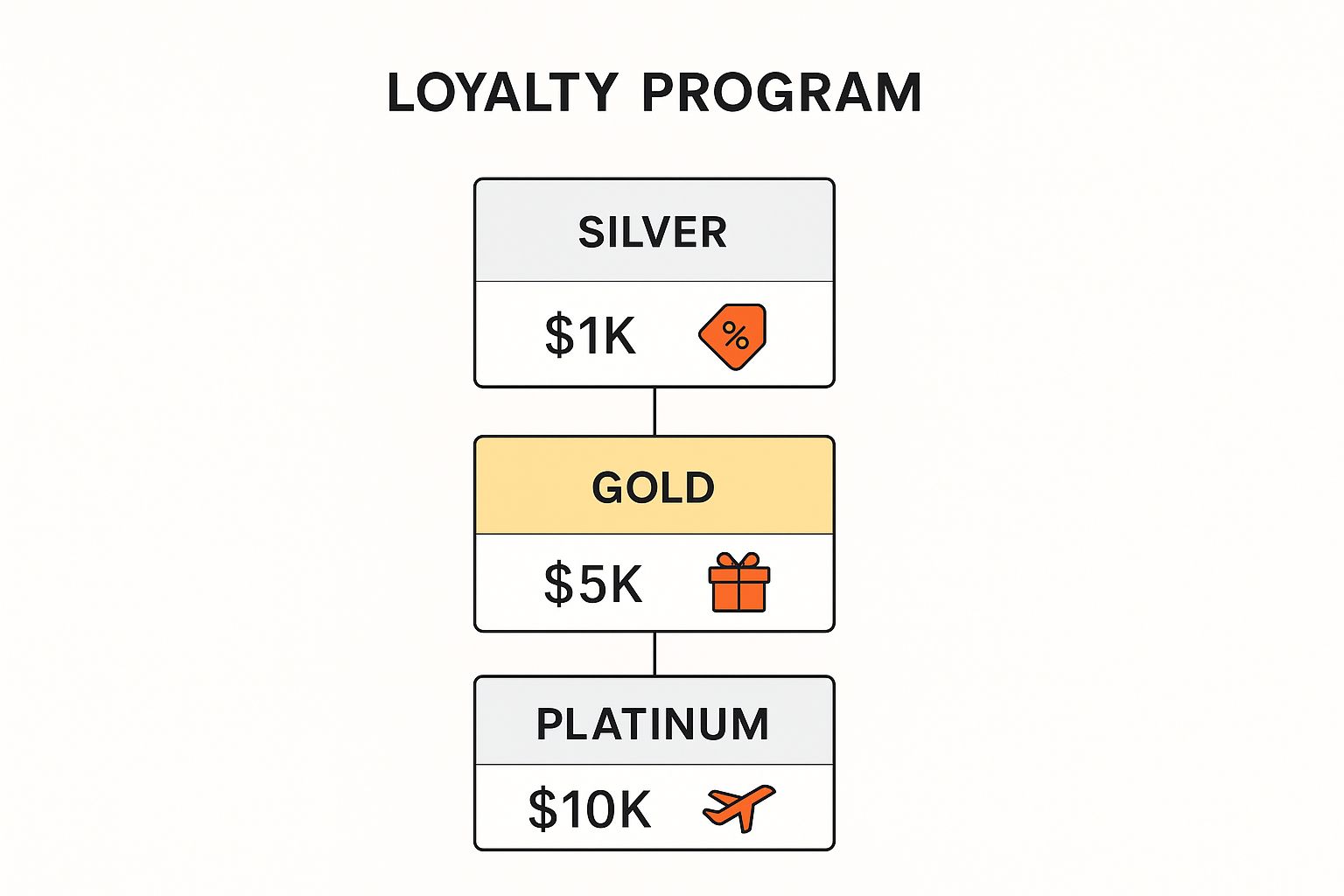

Additionally, it’s crucial to stay informed about special promotions that many retailers offer throughout the year, such as holiday sales or loyalty programs that provide extra cashback on certain items. To fully capitalize on these offers, keep track of your cashback earnings and regularly compare different programs to ensure you’re getting the best deals available. By implementing these strategies, you can efficiently turn routine purchases into a rewarding cashback experience, enhancing your financial health while enjoying the things you love.

How to Choose the Best Cashback Credit Cards for Your Lifestyle

Choosing the best cashback credit cards for your lifestyle begins with understanding your spending habits. Consider what categories you spend the most on, such as groceries, dining, travel, or gas. For instance, if you frequently dine out, look for a card that offers higher cashback rates in that category. Many credit cards offer tiered rewards, so you might earn 5% cashback on certain categories and 1% cashback on others. Make a list of your regular expenses and compare different cards to see which ones align with your spending patterns.

Another crucial factor to consider is the fees associated with the card. Some cashback credit cards come with annual fees, while others do not. It's essential to weigh the benefits of the rewards against the costs. Additionally, pay attention to the card's rewards redemption process. Cards that offer flexible redemption options, such as the ability to apply cashback towards your statement balance or convert it into gift cards, can provide greater value. By taking the time to evaluate your options, you can select a card that not only maximizes your rewards but also enhances your financial wellbeing.