2Mami Insights

Your go-to source for news, tips, and inspiration.

Digital Asset Trading: Where Pixels Meet Profits

Unlock the secrets of digital asset trading—turn pixels into profits and explore the future of investment in the digital realm!

Understanding Digital Assets: A Beginner's Guide to Trading Pixels

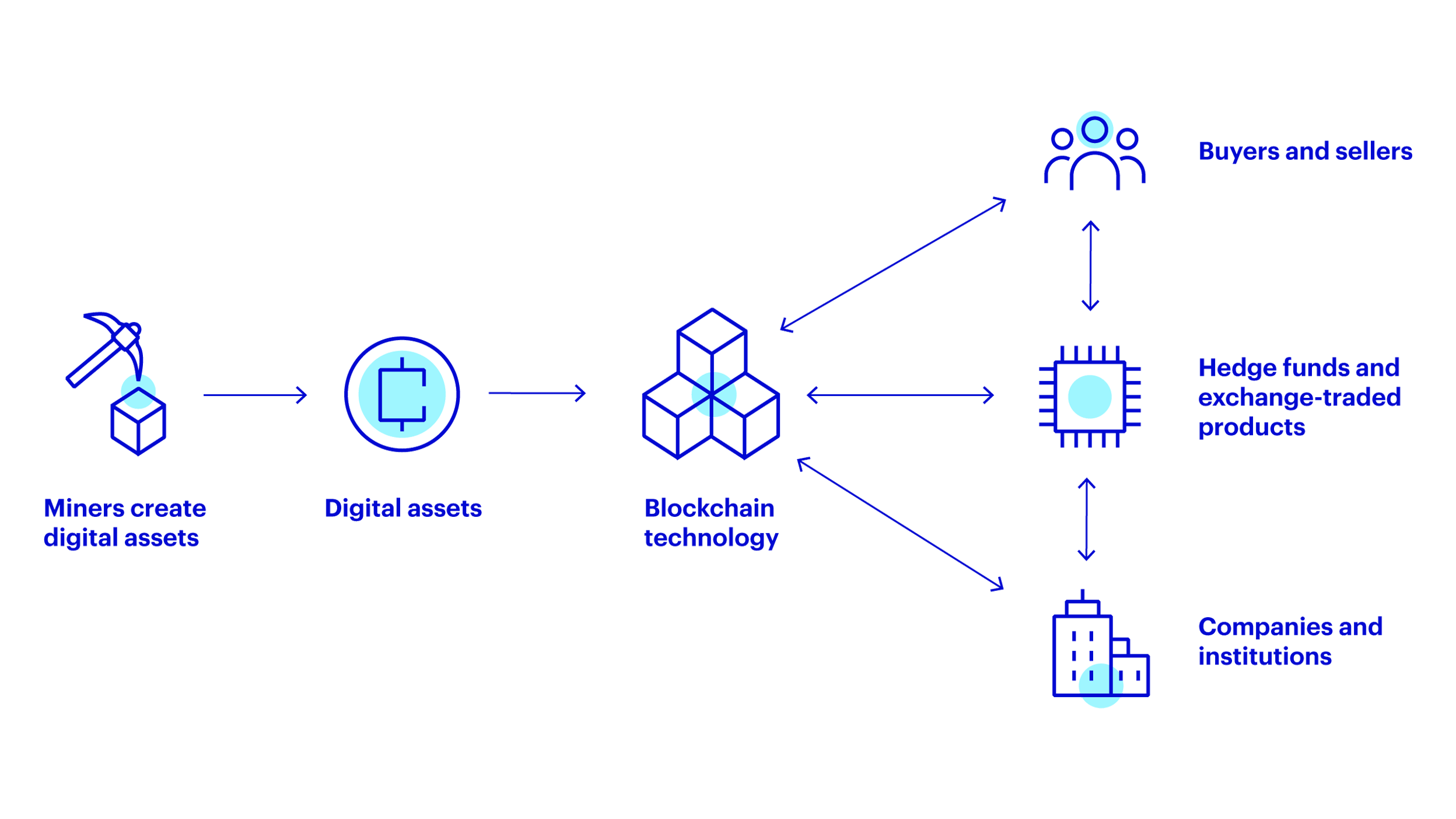

In the rapidly evolving digital landscape, digital assets have emerged as crucial components of online engagement and commerce. From cryptocurrencies to non-fungible tokens (NFTs), these pixels or virtual items carry significant monetary and intrinsic value. Understanding the different types of digital assets is essential for beginners looking to navigate this complex world. Start by familiarizing yourself with key concepts, such as how blockchain technology works and the factors that contribute to the valuation of digital assets.

Once you grasp the foundational knowledge, you can explore various platforms for trading these assets. Popular exchanges like Coinbase and OpenSea allow users to trade everything from digital currencies to unique digital collectibles. When getting started, be sure to research and assess market trends, as well as the potential risks involved. Additionally, consider joining online communities or forums to connect with experienced traders and gain valuable insights into the evolving world of digital asset trading.

Counter-Strike is a highly popular first-person shooter game that pits teams of terrorists against counter-terrorists in a variety of objective-based game modes. Players engage in tactical gameplay that requires teamwork, strategy, and quick reflexes. For those looking to enhance their gaming experience, you can check out the daddyskins promo code for some exciting in-game item deals.

Top Strategies for Maximizing Profits in Digital Asset Trading

In the fast-paced world of digital asset trading, understanding and implementing top strategies for maximizing profits is crucial. One effective approach is to diversify your portfolio across various digital assets such as cryptocurrencies, NFTs, and tokens. By spreading your investments, you not only reduce risk but also increase the potential for higher returns. Additionally, consider employing techniques like dollar-cost averaging, where you invest a fixed amount regularly regardless of market conditions. This strategy helps mitigate volatility and can lead to significant long-term gains.

Another key strategy for enhancing profitability is to stay informed and adaptable. The digital asset market is influenced by a myriad of factors, including regulatory changes and technological advancements. Use analytical tools and resources to track market trends and sentiment. Engaging in communities and forums can also provide valuable insights. Finally, always have an exit strategy in place; knowing when to sell your assets is just as important as when to buy them. By applying these strategies, traders can significantly increase their chances of achieving substantial profits in digital asset trading.

What Are the Risks and Rewards of Investing in Digital Assets?

Investing in digital assets, such as cryptocurrencies and tokenized assets, presents a unique set of risks and rewards. One of the significant risks is volatility; digital currencies can experience dramatic price swings in short periods, leading to potential losses. Additionally, the regulatory landscape surrounding digital assets is constantly evolving, which can introduce compliance challenges. Investors may also face cybersecurity threats, with hacks and fraud posing considerable risks to their holdings. According to a recent study, nearly 30% of investors reported being affected by a cyber incident at least once in their investing journey.

On the flip side, the rewards of investing in digital assets can be substantial. Many investors have seen significant returns, particularly during bull markets. Digital assets also offer a level of diversification that traditional markets may lack, as blockchain technology fosters the development of new investment opportunities. Additionally, investing in digital assets can provide early access to innovative technologies and business models, setting the stage for future growth. Overall, while the landscape is fraught with challenges, the potential for high returns beckons many investors, underscoring the importance of thorough research and a well-thought-out strategy.