2Mami Insights

Your go-to source for news, tips, and inspiration.

Term Life Insurance: The Unsung Hero of Financial Planning

Discover why term life insurance is the ultimate financial safety net everyone needs—your family's future depends on it!

Understanding Term Life Insurance: Key Benefits You Need to Know

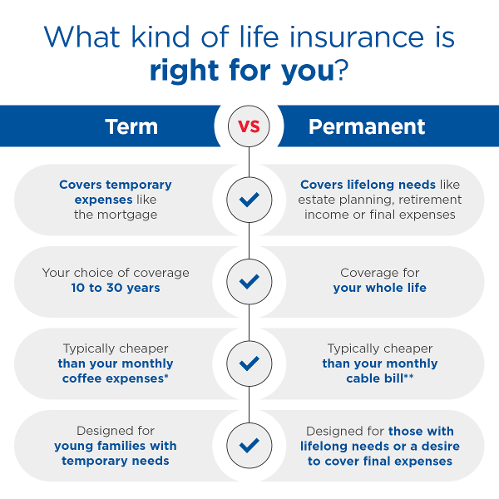

Understanding Term Life Insurance is crucial for anyone seeking financial security for their loved ones. Unlike whole life insurance, which compounds cash value over time, term life insurance offers coverage for a specified duration—typically ranging from 10 to 30 years. This type of policy is often favored for its affordability and simplicity. For instance, Investopedia explains that premiums are usually lower than those of permanent policies, making it a budget-friendly option for families on a tight financial plan.

One of the most significant benefits of term life insurance is its ability to provide large coverage amounts at a fraction of the cost, which is ideal for replacing lost income, covering debts, or paying for children's education in the event of the policyholder's untimely death. Additionally, many policies offer the option to convert to a permanent policy later on, giving policyholders flexibility as their financial needs evolve. For further details on this topic, check out NerdWallet for a comprehensive breakdown of life insurance types.

Is Term Life Insurance Right for You? A Comprehensive Guide

Term life insurance can be a vital part of your financial plan, offering affordable coverage to protect your loved ones in the event of your passing. Unlike whole life insurance, which provides lifelong coverage, term life insurance covers you for a specified period—usually between 10 to 30 years. During this time, if you were to pass away, your beneficiaries would receive a death benefit. Evaluating your needs, such as your current financial obligations and future goals, can help you determine if term life is the right option for you. For more information on understanding insurance policies, visit Investopedia's life insurance guide.

When considering if term life insurance is right for you, think about key factors such as your age, health, and financial responsibilities. For instance, if you have young children, a mortgage, or other debts, term life insurance could provide crucial financial support for your family during a challenging time. Additionally, opting for term life can offer significant savings compared to permanent life insurance products. An effective approach is to perform a cost-benefit analysis and consult reliable resources—like Forbes' explanation of term life insurance—to ensure that you are making an informed decision.

How Term Life Insurance Can Protect Your Family's Financial Future

Term life insurance serves as a vital safety net for families, providing financial security in the event of an untimely death. By paying a relatively low premium, policyholders can secure a death benefit that replaces lost income and covers essential expenses, such as mortgage payments, education costs, and daily living expenses. This form of life insurance ensures that your loved ones are financially supported, allowing them to maintain their standard of living during a challenging time. According to NerdWallet, having a term life insurance policy can offer peace of mind, knowing that your family's future is protected.

Moreover, term life insurance is typically straightforward and easy to understand, making it an ideal choice for many households. Unlike permanent life insurance, which can be more complex and costly, term policies provide coverage for a specified duration, often ranging from 10 to 30 years. This allows families to align their coverage with critical financial milestones such as their children’s education or retirement planning. As noted by Investopedia, the simplicity and affordability of term life insurance make it a highly accessible option for families looking to secure their financial future.