2Mami Insights

Your go-to source for news, tips, and inspiration.

Trade Bots: Your AI Sidekicks or Just Overhyped Code?

Uncover the truth about trade bots—are they your ultimate AI allies or just overhyped software? Click to find out!

Understanding Trade Bots: How They Work and What They Can Do

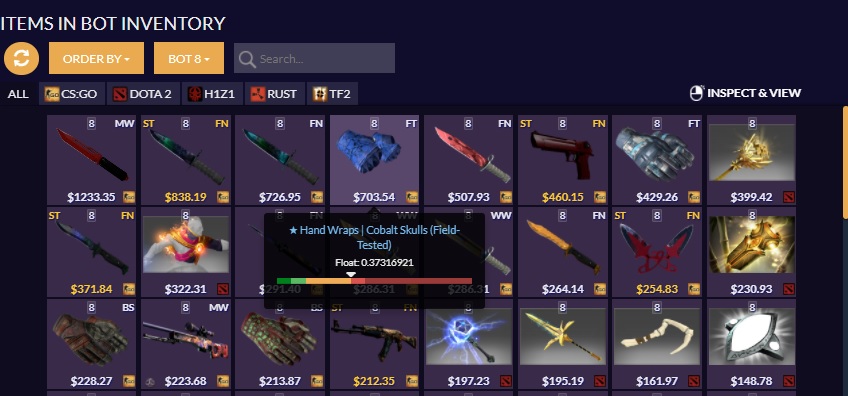

Understanding Trade Bots involves grasping the intricate mechanics that power these automated trading systems. Trade bots are software applications that execute trades on behalf of users based on predefined criteria and algorithms. They analyze market data, apply various trading strategies, and promptly react to market fluctuations far quicker than a human trader could. Typically available for various trading platforms, these bots can operate around the clock, ensuring that trading opportunities are never missed, even when the trader is away from their screen.

Trade bots can perform a variety of functions, from market analysis to executing buy and sell orders. Some bots utilize machine learning and artificial intelligence to improve their trading strategies over time, adapting to changing market conditions. They can also be programmed to follow specific technical indicators, set stop-loss limits, and diversify portfolios automatically. By understanding how trade bots work and what they can do, traders can leverage these tools to enhance their trading efficiency and potentially increase profitability.

If you're curious about the role of automated tools in trading, you might find it interesting to explore the debate around their effectiveness. For a deep dive into this topic, check out my blog post on Trade Bots in CS2: Your New Best Friends or Just Fancy Scripts?, where I analyze the pros and cons of using these advanced scripts in your trading strategy.

Are Trade Bots the Future of Trading or Just a Fad?

In recent years, the rise of trade bots has captured the attention of both novice and experienced traders. These automated systems are designed to execute trades on behalf of users, leveraging algorithms to analyze market trends and make decisions in real time. This has fueled a debate on whether trade bots represent the future of trading or if they are merely a passing trend. Proponents argue that the efficiency and speed of these bots can allow for more informed trading decisions, potentially leading to greater profits. However, skeptics question their reliability, citing market unpredictability as a significant risk factor.

As we consider the potential of trade bots, it's essential to examine their advantages and disadvantages:

- Advantages:

- 24/7 trading capability

- Elimination of emotional decision-making

- Ability to analyze large datasets quickly

- Disadvantages:

- Risk of technical failures

- Dependence on market conditions

- Potential for over-optimization

Ultimately, while trade bots may offer innovative solutions, their long-term viability in the trading landscape depends on ongoing technological advancements and market acceptance.

Maximizing Your Trading Success: Do Trade Bots Really Deliver?

In the ever-evolving world of trading, one question consistently arises: do trade bots really deliver on their promises? These automated systems are designed to execute trades at high speeds, often based on complex algorithms and market analysis. They have gained popularity among both novice and experienced traders who seek to enhance their trading strategies and maximize their potential gains. However, while trade bots can potentially offer numerous advantages, such as eliminating emotional decision-making and executing trades 24/7, they are not without their drawbacks. Investing in a trade bot without proper research and understanding can lead to significant losses, as effectiveness largely depends on the underlying algorithms and market conditions.

To truly maximize your trading success with trade bots, it is essential to approach them with a strategic mindset. Here are a few tips to consider:

- Research: Understand the different types of trade bots available and choose one that aligns with your trading goals.

- Test: Use a demo account to test the bot's performance before committing real funds.

- Monitor: Regularly review the bot’s performance and make adjustments as necessary.

By following these guidelines, traders can better assess whether trade bots can deliver on their promises and contribute to an overall winning trading strategy.