2Mami Insights

Your go-to source for news, tips, and inspiration.

Why Your Insurance Coverage Could Use a Reality Check

Is your insurance coverage up to par? Discover the shocking gaps that could cost you—read on for a crucial reality check!

Is Your Insurance Coverage Doing Enough? A Comprehensive Reality Check

In today's ever-changing landscape, it’s crucial to ask yourself: Is your insurance coverage doing enough? Many individuals and families secure insurance policies with the assumption that they are fully protected. However, without a comprehensive reality check, you might be overlooking critical aspects of your policy that could leave you vulnerable. Consider reviewing your coverage options regularly to ensure they meet your current needs, as life circumstances, such as marriage, purchasing a home, or welcoming a child, can significantly alter your insurance requirements.

Take a moment to assess your policy's key components. Start with documenting your assets and liabilities to understand what you need to protect and what risks you may face. Here are some important questions to consider:

- Does your homeowner's or renter's insurance cover all your personal belongings?

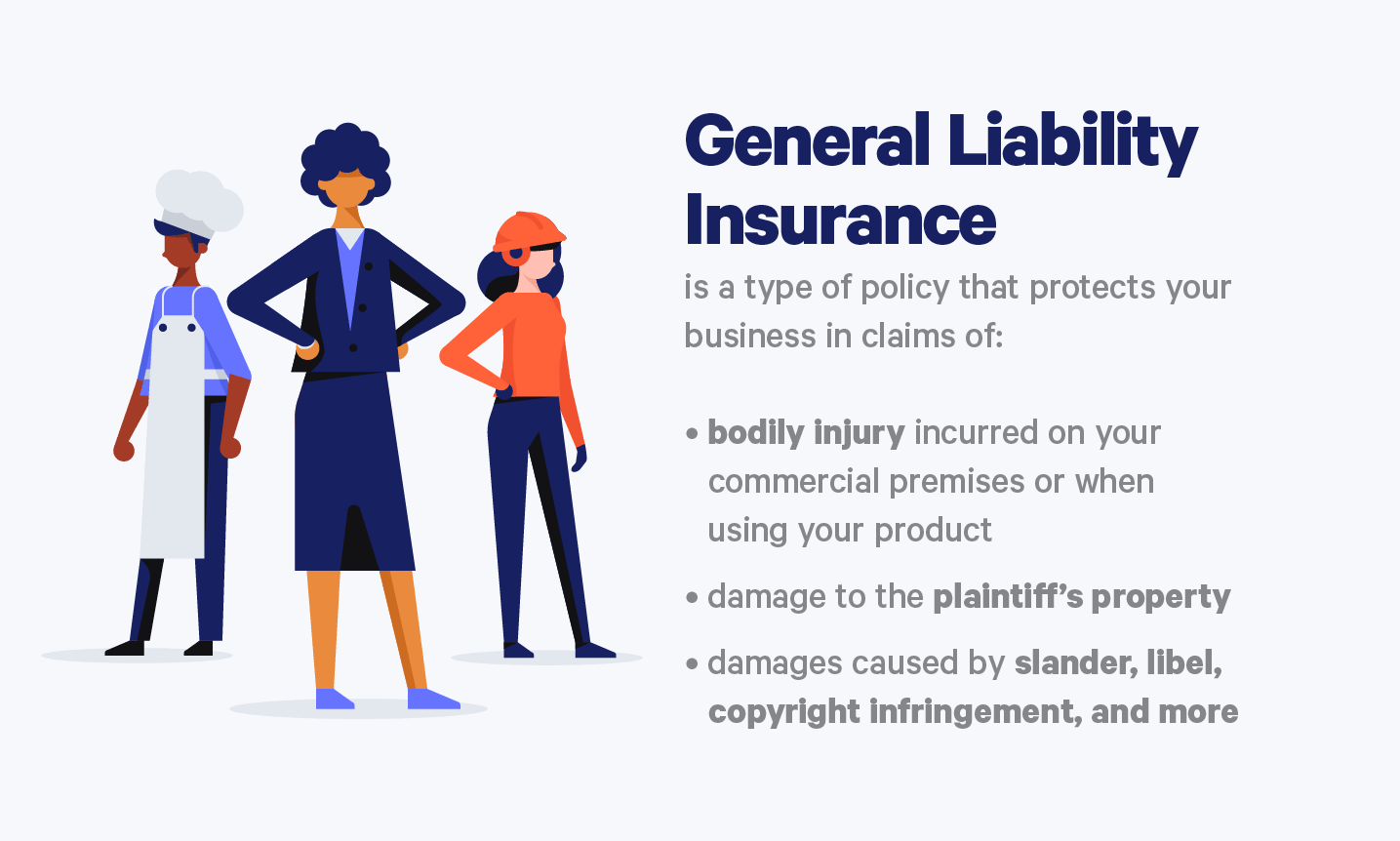

- Are you adequately insured for liability in case of accidents on your property?

- Have you considered additional coverage for natural disasters?

Top Signs Your Insurance Policy Needs a Serious Review

If you haven't reviewed your insurance policy in the last few years, it may be time for a serious reassessment. Life changes, such as marriage, starting a family, or buying a home, can significantly impact your insurance needs. Additionally, if you have acquired valuable assets or made large purchases, it’s crucial to ensure your coverage reflects these changes. Look for indicators that your current policy may no longer suffice, such as an increase in your asset value, which might require additional coverage to protect your investment.

Another strong signal that it’s time to review your insurance policy is if you're experiencing premium hikes or feel that your current premiums do not align with the coverage provided. As insurance companies adjust rates based on various factors including claims history, market conditions, and your personal circumstances, staying informed about your policy’s value is essential. Consider the benefits of shopping around for competitive quotes or discussing your policy with an insurance agent to ensure you have the most suitable coverage at a reasonable price.

Are You Overpaying for Insurance? Uncovering Hidden Gaps in Coverage

In today's fast-paced world, many individuals unknowingly pay a premium for their insurance without realizing they may be overpaying due to hidden gaps in coverage. Are you overpaying for insurance? This question is critical, as it highlights the need to evaluate your current policies thoroughly. Common gaps in policies can include inadequate liability coverage, the absence of personal injury protection, or lack of specific endorsements for valuable items. To uncover these hidden gaps, it’s essential to review your policy details and consult with an insurance expert to ensure that your coverage aligns with your current needs and lifestyle.

Moreover, it’s vital to keep your insurance updated with life changes such as marriage, buying a home, or acquiring new assets. Regularly comparing your insurance options can also reveal more cost-effective solutions that provide comprehensive coverage. Consider creating a checklist of essential coverages to ensure you aren't missing any critical components that could lead to significant out-of-pocket expenses in the event of a claim. By asking yourself, “Am I overpaying for insurance?” and performing a thorough assessment, you can save money while ensuring robust protection for yourself and your assets.